- News

- Property

House prices - October 2025

The housing market was more subdued than usual in October. There are two very different factors behind it – short-term uncertainty ahead of the Autumn Budget, and a longer-term shift caused by the rising supply of new homes to the market.

Speculation that the Chancellor could raise property taxes in the Budget has meant many buyers and sellers are waiting for some more clarity before committing to a move, especially in higher-value areas in London and the South. At the same time, the growing number of homes for sale is also keeping a lid on prices. After years of shortages, supply has now climbed to its highest level in a decade, giving buyers more choice and forcing sellers to be realistic with their pricing.

Rightmove reports that average new-seller asking prices rose by just 0.3% in October to £371,422, which is well below the more typical 1.1% seasonal rise.

Colleen Babcock, property expert at Rightmove, says: “Despite the overall resilience of the 2025 housing market, we’ve not got enough pent-up momentum or recent positive sentiment to spur the usual autumn bounce in property prices.

“We’re experiencing a decade-high level of property choice for buyers, which means that sellers who are serious about selling have had to acknowledge their limited pricing power and moderate their price expectations.”

Competitively-priced homes, though, are still finding buyers even while others wait for the Budget, with Rightmove’s data showing agreed sales are running 5% higher than they were a year ago.

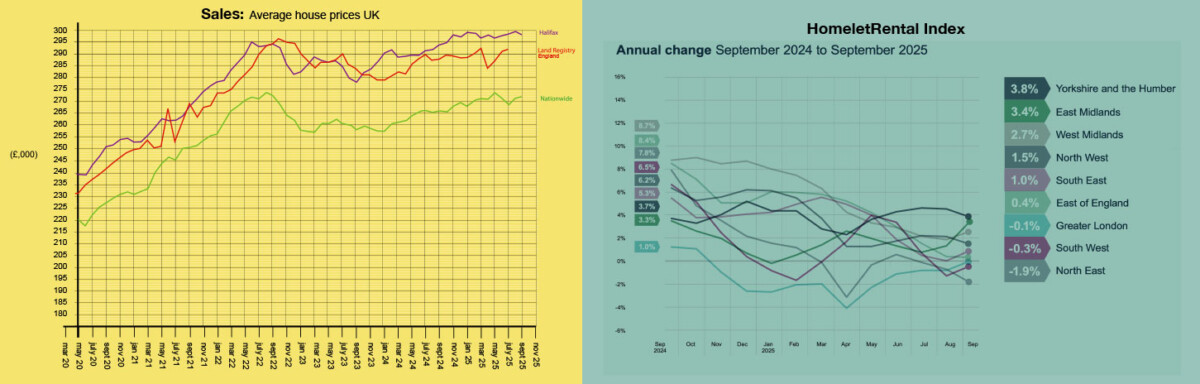

The big lenders’ data paints a similar picture. Nationwide’s HPI recorded a 0.3% monthly rise in October, taking annual growth to 2.4% and average prices to £272,226, while Halifax reports house prices have climbed by 0.6%, pushing annual growth to 1.9% and setting a new record average of £299,862. Both report that mortgage approvals are at their strongest level in 2025, showing underlying demand remains intact.

According to Halifax, it’s the more reasonably priced areas that are leading the annual growth tables. Northern Ireland is in top spot at +8%, followed by the North East, which recorded the highest annual growth rate in England at +4.1%. In contrast, London (-0.3%) and the South East (-0,1%) saw mild year-on-year declines as affordability pressures and Budget uncertainty weighed more heavily on confidence.

HOUSE PRICES AND STATISTICS

For once, all the main indices are closely aligned, showing we are going through a clear trend of subdued but rising prices.

Rightmove: Oct: Avg. price £37371,422. Monthly change +0.3%. Annual change -0.1% (asking prices)

Nationwide: Oct: Avg. price £272,266. Monthly change +0.3%. Annual change +2.4%

Halifax: Oct: Avg. price £299,862. Monthly change +0.6%. Annual change +1.9%

Land Registry (England): Aug: Avg. price £295,670. Monthly change +0.9%. Annual change +2.9%

Zoopla: Sept: Avg. price £270,000. Annual change +1.3%

BUY-TO-LET

Average rents have reached new highs across the UK, but the pace of growth is easing as more homes return to the market and tenants’ budgets become over-stretched.

Rightmove’s latest Rental Trends Tracker shows that the average advertised rent outside London rose by 1.5% in the third quarter of 2025 to £1,385 per month, 3.1% higher than a year ago. In London, average rents increased by 0.9% to £2,736, up just 1.6% annually – the slowest pace since 2020.

The number of available rental homes is now 9% higher than a year ago, the closest the market has been to pre-pandemic levels for four years. However, new rental listings are up by only 1%, suggesting the increase in supply is mainly from churn, ie existing homes being re-let rather than new landlords entering the market.

HomeLet’s October index also shows rents holding at record highs rather than climbing. The average UK rent was £1,345 last month, unchanged from September and 1.4% higher than a year ago. Outside London, rents slipped by 0.3% to £1,138 but remain 1.7% up annually, while in the capital the average rose 0.9% to £2,218.

As ever, there are marked regional differences, with annual growth of 4.5% in the North West, 3.5% in Yorkshire and the Humber, and more than 8% in Northern Ireland, while London rents are largely flat. HomeLet also reports tenants now spend an average of 32% of their income on rent, down slightly from 32.8% last year, but still high by historic standards.