- Finance

- Interest rates

- Mortgage

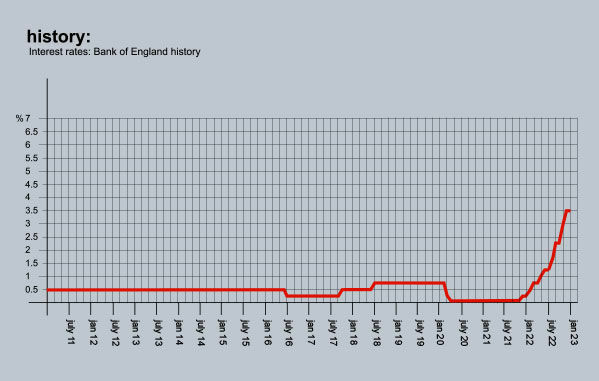

Mortgages and interest rates - January 2023

At the start of 2022, there were plenty of fixed-rate deals around the 1% mark for anyone with a decent-sized deposit. Runaway inflation meant they didn’t stay that low for long. The base rate rose 8 times during the course of the year, reaching 3.5% in December. And, in the midst of it all, along came Liz Truss’ mini-budget, spooking the money markets and pushing the average fixed rate mortgage as high as 6.65%. Fortunately, after her departure, the money markets settled and, at the end of last year, mortgages were coming back down, the best fixed-rate deals dipping to just under 5% (average 5.75%).

This year, economists are factoring in a number of further base rate rises. The first is expected in February (+0.5%). It will then be followed by one or two more until it reaches 4.5% towards the back end of 2023/beginning of 2024 when inflationary pressure starts to ease. Mortgage rates, in contrast, are likely to head downward throughout 2023, as swap rates fall and lenders face increasing competition for new business as borrowers hold off on purchases, waiting for both house prices and finance costs to fall. Lenders are already reporting low take-up of their products and have been busy slashing their prices. As a result, average fixed-rate mortgages should come down to between 4% and 5% over the next twelve months and 60% LTV rates could be as much as 1% lower.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 4.79% from Nationwide. Product fee £999. 60% LTV.

4.99% from Generation Home. Product fee £999. 60% LTV.

Three-year fixed rates: 4.79% from Nationwide. Product fee £999. 60% LTV.

4.74% from MPowered Mortgages. Product fee £0. 60% LTV.

Five-year fixed rates: 4.44% from Nationwide. Product fee £999. 60% LTV.

4.59% from Nationwide. Product fee £0. 60% LTV.

Discounted variable: 3.29% Until 31/01/2025. From Newcastle BS. Product fee £999. 80% LTV.

3.29% For 2 years. From Progressive BS. Product fee £0. 60% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 4.29% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV.

Five-year fixed rate: 4.69% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV

Best Discounted variable: 3.99% for 2 years. From Loughborough BS. Completion £499. 75% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.