- Finance

- Interest rates

- Mortgage

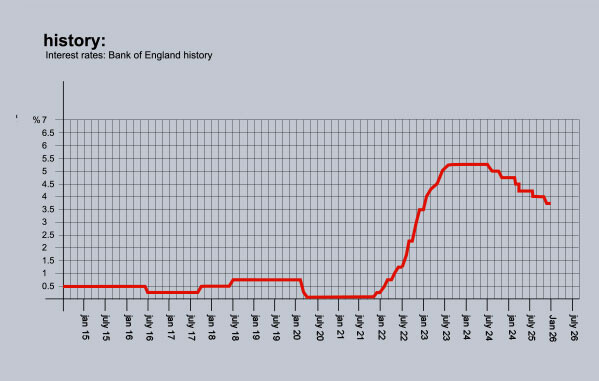

Mortgages and the base rate

Last month, the Bank of England voted by 5–4 to cut the base rate by 0.25 percentage points to 3.75%, its lowest level in almost two years. Many high-street lenders had already been trimming fixed-rate pricing ahead of the decision, which was widely anticipated.

That is because mortgage pricing is heavily influenced by swap rates — the market’s view of where interest rates are heading over the life of a loan, rather than the current base rate. At the same time, a quieter housing market has meant lenders are having to compete harder for business and, together, they are exerting considerable downward pressure on mortgage rates.

As a result, average fixed rates are now below 5%. According to Moneyfacts, the average two-year fixed rate was 4.83% at the start of January 2026, with the average five-year fix at 4.91%, and a high number of deals on offer. For those with larger deposits, there are quite a few fixed rates as low as 3.5%.

There has also been a modest improvement in higher loan-to-value mortgages, with more 90% and 95% LTV options now available, giving first-time buyers more routes to the market, even though affordability remains stretched.

Looking ahead, borrowing costs are likely to continue coming down. Inflation is expected to ease further, with the OBR forecasting CPI inflation to fall to an average of 2.5% in 2026. At the same time, the labour market is softening, with the unemployment rate hitting 5.1% in the three months to October 2025. Together, this should provide the B of E enough headroom to reduce the base rate.

The money markets are therefore anticipating two further quarter-point base rate cuts in 2026, which could see some of the best-buy fixed deals dipping below 3.5%.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 3.70% from Nationwide. Product fee £999. 60% LTV. For remortgages.

3.70% from first direct. Product fee £490. 60% LTV.

Five-year fixed rates: 3.79% from Nationwide. Product fee £999. 60% LTV. For remortgages.

3.79% from first direct. Product fee £490. 75% LTV

Discounted variable: 4.09% From Ecology BS. Product fee £0. 80% LTV.br> 4.14% From Furness BS For 2 years. Product fee £999. 80% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 2.61% from Birmingham Midshires. Arrangement fee 3.00% Advance. 75% LTV.

Five-year fixed rate: 3.38% from BM Solutions. Arrangement fee 3.00% Advance. 65% LTV.

Best Discounted variable: 4.40% For 5 years. From Newbury BS. Arrangement £950. 75% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.