- News

- Property

House prices - August 2025

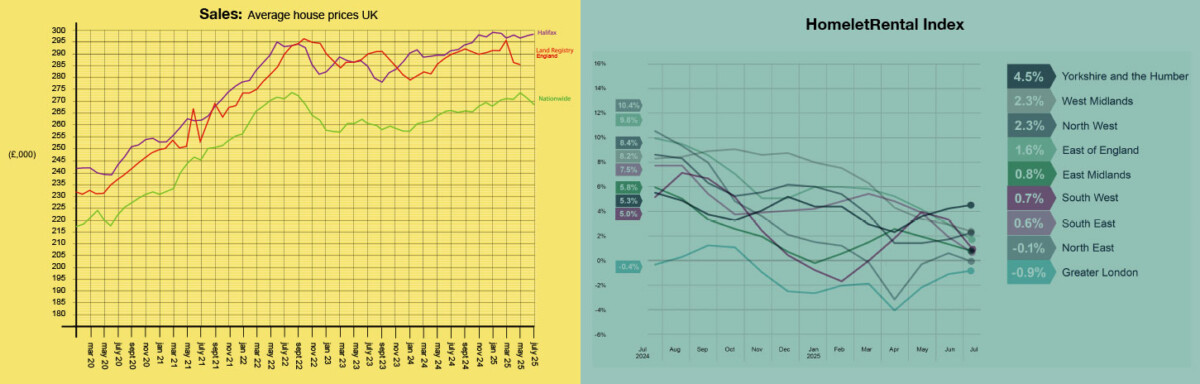

The housing market is holding up well despite uncertainties over the direction of the economy, with Halifax and Nationwide reporting solid price growth in July. However, the gap between asking prices and completed sales is widening, suggesting buyers are becoming more selective as supply levels reach a decade high.

According to Halifax, house prices rose by 0.4% last month – the biggest monthly increase since the start of this year – taking the average house price to £298,237, some 2.4% higher than a year ago. Nationwide was similarly upbeat, with prices up 0.6% for the month and annual growth also at 2.4%.

The stamp duty changes implemented in April are still working their way through the system, particularly in higher-value areas. Activity levels, though, have proved surprisingly resilient, helped by the downward trend in the base rate and the latest reduction, although the pace of future cuts may now slow.

Lenders’ recent changes to affordability criteria have also helped support the market, allowing some buyers to borrow up to 20% more than they could just three months ago. At the same time, there has been strong income growth and affordability has improved as a result of more modest house price growth.

Regional variations continue. London remains subdued following the April stamp duty changes, whilst the more affordable northern regions are showing more consistent growth.

Robert Gardner, Nationwide’s Chief Economist, says:

“Despite wider economic uncertainties in the global economy, underlying conditions for potential home buyers in the UK remain supportive.

“Unemployment remains low, earnings are still rising at a healthy pace (even after accounting for inflation), household balance sheets are strong and borrowing costs are likely to moderate a little further if Bank Rate is lowered further in the coming quarters as we, and most other analysts, expect.

“Providing the broader economic recovery is maintained, housing market activity is likely to continue to strengthen gradually in the quarters ahead.”

HOUSE PRICES AND STATISTICS

There is some variation in the monthly figures, though annual growth rates are remarkably consistent, showing a clear pattern is emerging:

Nationwide: July: Avg. price £272,664. Monthly change +0.6%. Annual change +2.4%

Halifax: July: Avg. price £298,237. Monthly change +0.4%. Annual change +2.4%

Land Registry (UK): May: Avg. price £290,395. Monthly change +1.3%. Annual change +3.4%

Zoopla: June: Avg. price £268,400. Annual change +1.3%

Rightmove: July: Avg. price £373,709. Monthly change -1.2%. Annual change +0.1% (asking prices)

BUY-TO-LET

Rents continue to moderate from their post-pandemic peaks, with the clearest signs yet that the market is finally normalising. The average rental price reached £1,313 in July, up just 0.4% from June and only 0.4% higher than a year ago – a dramatic slowdown from the double-digit growth rates seen in recent years.

London is going through an even more pronounced cooling period, with rents now 0.9% cheaper than they were a year ago. This represents a significant turnaround for a market that had become accustomed to relentless upward pressure.

And the fundamentals are finally moving in tenants’ favour. The number of available properties is 15% higher than at this time last year, while the number of prospective tenants looking to move is 10% lower. Properties are taking longer to let as a result – an average of 25 days for a rental home to be marked let agreed on Rightmove, up from 21 days last year.

On a more positive note for landlords, investment activity has picked up significantly. UK Finance reports a 17% increase in total loans to BTL investors this year, including a 28% uplift for new rental home purchases, which should help bring much-needed additional supply to the market. Despite the improvements, affordability, though, remains stretched for many tenants.