- Finance

- Mortgage

Mortgages and interest rates - August 2023

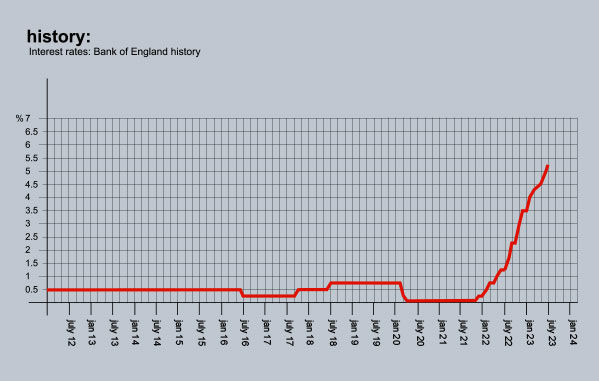

On the back of last month’s inflation figures, the Bank of England’s Monetary Policy Committee raised the base rate by 0.25% rather than the 0.5% many had feared. This month’s data has now been released and confirms inflation is continuing on its downward path, falling from 7.9% to 6.8%. There are, though, still concerns about core inflation, which only came down very slightly from 6.9% to 6.8%, and wage inflation, which went up to 7.8%. And, although food inflation came down from 17.4% to 14.9%, it remains very high.

Unlike the base rate, increasing competition between lenders and reducing inflation meant mortgage rates fell rather than rose. However, any expectations that the base rate would soon follow suit were quickly quashed by Andrew Bailey, governor of the Bank of England. He said there would need to be “solid evidence” that rapid price rises are slowing and that wage inflation had eased before there would be any reductions, and he didn’t expect that to happen anytime soon. As a consequence, the money markets are now forecasting that there will be another 0.25% rise in September, after which the base rate will remain at 5.5% for around 12 more months.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 6.19% from Nationwide. Product fee £999. 60% LTV.

6.54% from Nationwide. Product fee £0. 60% LTV.

Three-year fixed rates: 5.99% from Nationwide. Product fee £999. 60% LTV.

6.28% from Gen H. Product fee £999. 70% LTV.

Five-year fixed rates: 5.64% from Nationwide. Product fee £999. 60% LTV.

5.79% from Nationwide. Product fee £0. 60% LTV.

Discounted variable: 4.84% For 2 years. From Beverley BS. Product fee £1,495. 65% LTV.

4.94% For 2 years. From Beverley BS. Product fee £995. 80% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 4.99% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV.

Five-year fixed rate: 5.19% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV

Best Discounted variable: 4.54% For 2 years. From Mansfield BS. Booking £199, Completion 2.50% Advance. 75% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.