- Finance

- Mortgage

Mortgages and interest rates - Dec 2024

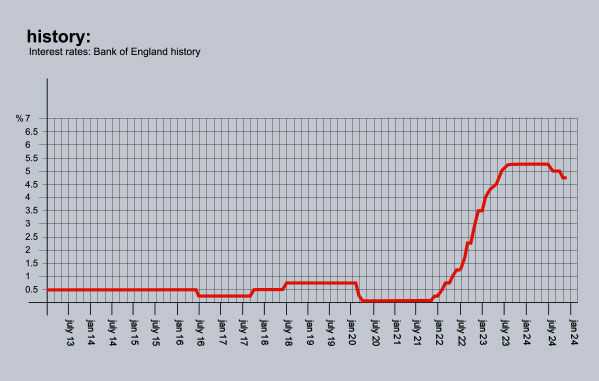

Mortgage rates have retreated from their recent highs but there is no Christmas cut expected from Bank of England.

Despite two base rate cuts bringing it down to 4.75%, hopes of an early Christmas present from the Bank of England have been dashed by November’s sharp jump in inflation to 2.6%. This unexpected rise, combined with concerns about the inflationary impact of Labour’s budget tax increases on businesses, means rates are likely to remain on hold until the New Year.

Major high street lenders, though, including Barclays, NatWest and Santander have reduced their fixed rates this month, though the best deals remain above 4%. The lowest five-year fixes are now around 4.09% while two-year deals sit at 4.21%.

Although analysts are expecting four more cuts in 2025, potentially bringing rates down to around 3.75%, there is the real possibility there will be fewer reductions following the Chancellor’s £40 billion tax rises and an extra £32.3 billion of borrowings.

Bank of England Governor Andrew Bailey has said the budget increase in National Insurance and the effect it may have on inflation are currently one of his biggest concerns, suggesting he may well take a cautious approach to future rate cuts.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 4.27% from Yorkshire BS. Product fee £1,495. 60% LTV.

4.34% from Nationwide BS. Product fee £999. 60% LTV.

Three-year fixed rates:4.27% from Yorkshire BS. Product fee £1,495. 60% LTV.4.29% from Nationwide BS. Product fee £999.

Five-year fixed rates: 4.14% from Nationwide BS. Product fee £999. 60% LTV.

4.17% from Yorkshire BS. Product fee £1,495. 60% LTV.

Discounted variable: 4.24% For 2 years. From Progressive BS. Product fee £0. 75% LTV.

4.49% For 2 years. From Newbury BS. Product fee £850. 75% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 3.39% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV.

Five-year fixed rate: 3.94% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV

Best Discounted variable: 4.85% For 5 years. From Newbury BS. Arrangement £950. 75% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.