- Finance

- Interest rates

- Mortgage

Mortgages and interest rates - April 2023

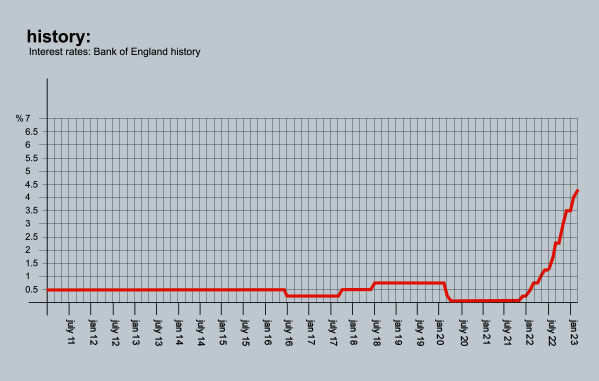

The base rate rose yet again last month to 4.25%, its 11th rise in a row. Average fixed-rate mortgages, which are based more on the future base rate than the current one, have been heading in the opposite direction.

According to Moneyfacts’ data, two- and five-year fixed-rate mortgages are now at a six-month low. The average five-year fix has dropped to 5.0%, but at 60% LTV, borrowers can now get sub 4.0% deals. For two-year fixes, the average is a little higher at 5.32% and 4.3% at 60% LTV. Variable rates, in contrast, have been steadily climbing, as they are directly linked to the base rate. Lenders’ standard variable rates are currently at an average of 7.12%.

The big question is whether the base rate has peaked. Inflation remains high, at 10.4%, and with the cost of fuel likely to rise, there will be further upward pressure on prices. As a result, the money markets expect the base rate to hit 4.5% sometime this year and then fall back to 3% over the following five years. It should be noted, though, that there will be an election next year and that could alter the outlook considerably.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 4.29% from Nationwide. Product fee £999. 60% LTV.

4.49% from Nationwide. Product fee £0. 60% LTV.

Three-year fixed rates: 4.14% from Nationwide. Product fee £999. 60% LTV.

4.38% from Nationwide. Product fee £0. 60% LTV.

Five-year fixed rates: 3.94% from Nationwide. Product fee £999. 60% LTV.

4.04% from Nationwide. Product fee £0. 60% LTV.

Discounted variable: 3.79% For 2 years. From Progressive BS. Product fee £0. 60% LTV.

3.80% For 2 years. From Chorley BS. Product fee £999. 80% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 3.99% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV.

Five-year fixed rate: 4.39% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV

Best Discounted variable: 3.99% From Hanley BS. Booking £299. 80% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.