- Finance

- Interest rates

- Mortgage

Mortgages and interest rates - February 2023

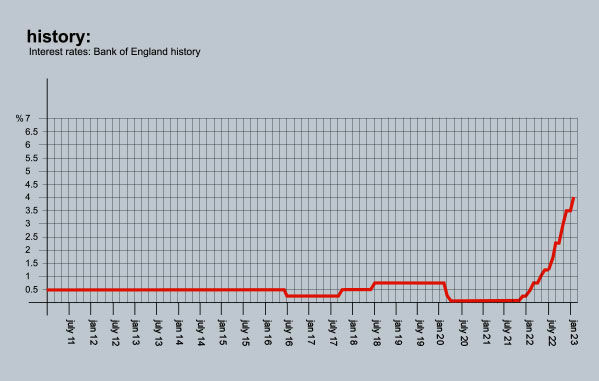

The Bank of England raised the base rate by another 0.5% to 4.0% this month. It is the highest it has been since October 2008 and is the tenth rise in a row. It was not a narrow decision, either – the bank’s MPC (Monetary Policy Committee) voted by seven to two in favour. The outlook is improving, though. Inflation, and energy costs in particular, have been falling and the Bank’s Governor – Andrew Bailey – said it might be a sign that “a corner has been turned”. Even so, the expectation is that the base rate will go up again during the course of this year but only by another 0.5% (4.5%).

Mortgage costs, in contrast, continue to head downwards. That is because they are based on the rates banks themselves pay to borrow money (swap rates). These are affected by both perceived risk and the future direction of the base rate rather than its current position and have been falling in recent weeks. In addition, competition between lenders can also have a significant impact and, right now, a large number of people are holding off getting a new mortgage as they wait for rates to fall. As a consequence, lenders are fighting over a much-reduced pool of customers and the best five-year fixed rates have dropped below 4.0% for those with a 40% deposit.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 4.64% from Generation Home. Product fee £999. 80% LTV.

4.69% from Nationwide. Product fee £999. 60% LTV.

Three-year fixed rates: 4.69% from Nationwide. Product fee £999. 60% LTV.

4.80% from Generation Home. Product fee £999. 60% LTV.

Five-year fixed rates: 4.34% from Nationwide. Product fee £999. 60% LTV.

4.44% from Nationwide. Product fee £0. 60% LTV.

Discounted variable: 3.14% From Hanley BS. Product fee £1,000. 60% LTV.

3.24% For 2 years. From Progressive BS. Product fee £0. 60% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 3.99% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV.

Five-year fixed rate: 4.39% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV

Best Discounted variable: 3.99% From Hanley BS. Booking £299. 80% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.