- News

- Property

Property news - April 2023

The health of the housing market depends more on transaction volumes than price rises. The price increases seen over the last couple of years were unsustainable and had stretched affordability to its limits. The Truss mini-budget in September 2022 accelerated the inevitable slowdown and, now, with mortgage rates coming down and the economic outlook improving, the housing market is returning to more normal levels.

According to the latest data from Zoopla, demand in March reached its highest level since the mini-budget, up by 16% compared to pre-pandemic levels (2019) for the month. Sales are the best measure of the housing market, and they were up by 11% when compared to the same period and mortgage approvals were up by 9.8%. The lack of supply of new houses to the market has been another issue over the last couple of years and this, too, is showing real signs of improvement. Last year, the average estate agency branch had just 14 homes on their books. This year, it’s 25. Those numbers are important because buyers need choice. If choices are limited, buyers won’t put their own homes on the market, further restricting supplies and forcing up prices.

According to Zoopla, “Arguably, the market is more in balance than at any time for the last 3 years.” Rightmove has reached a similar conclusion. Tim Bannister Rightmove’s Director of Property Science says:

“The beginning of the spring season sees stability and confidence continuing to return to the market as it recovers from the turbulence at the end of 2022. The pace of the market reached an unsustainable level in the last two years and was on track to slow to a more normal level, though the speed of this slowdown to more normality was accelerated by the reaction to September’s mini-Budget. While higher mortgage rates and economic headwinds raise challenges, many potential home movers who were effectively side-lined in the frenetic bidding wars of the last two years will find that a slower-paced market gives them time to plan and secure their next move as we enter the traditionally busy spring-buying season.“

He notes, however, that much of that recovery is being driven by more affordable homes, especially one and two-bed apartments in more urban areas, such as London, with top-of-the-ladder and second-stepper homes sectors lagging some way behind.

Looking ahead, with mortgage rates unlikely to drop much more this year and inflation remaining stubbornly in double digits, the onus will be on sellers to keep their prices competitive. A healthy labour market, rising wages and high rents will ensure, though, there will be plenty of buyers, but only if the price is right.

HOUSE PRICES AND STATISTICS

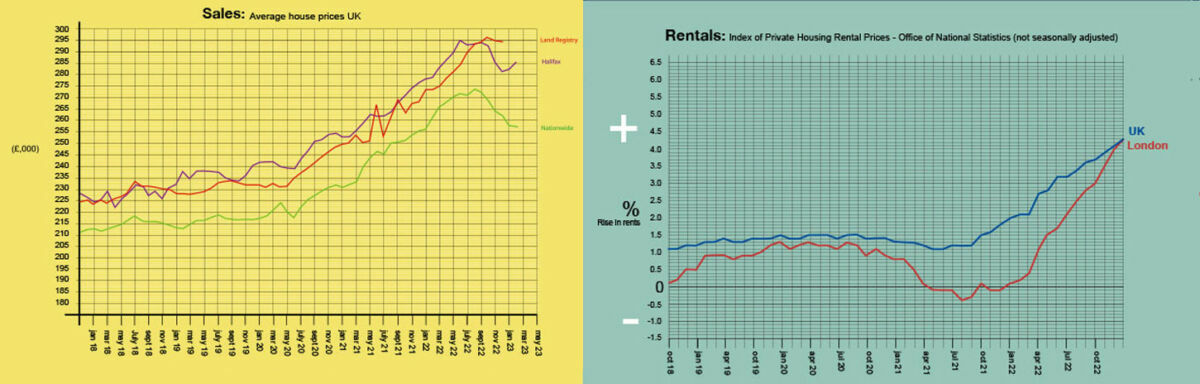

There is quite a lot of variation between the indices this month, which is indicative of changing market conditions. Annual growth figures, on the other hand, are all coming down to more normal levels when compared to the double-digits seen over the last couple of years.

Nationwide: Mar: Avge. price £257,122. Monthly change -0.8%. Annual change -3.1%

Halifax: Mar. Avge. price £287,880. Monthly change 0.8%. Annual change +1.6%

Land Registry: Jan: Avge. price £289,818. Monthly change -1.1%. Annual change +6.3%

Zoopla: Feb: Avge. price £259,700. Annual change +4.1%

Rightmove: Mar: Avge. price £365,357. Monthly change +0.8%. Annual change +3.0% (asking prices on Rightmove)

BUY-TO-LET

To get an idea of what is going on in the rental sector, all you have to do is take a look at these statistics – over the last five years, demand has risen by 46% while supply has fallen by 38% (Zoopla). The source of the imbalance is not hard to find – the government’s tax and legislative assault on landlords has meant many decided to sell up, severely constricting supply, just as the market was growing. It was hoped that, in the spring budget, the government might at least allow landlords to offset their costs (mortgages) against their profits. To the disappointment of many, they failed to do so. Instead, they raised corporation tax, which will have a direct effect on all those who had moved their rental portfolios to companies specifically so they could offset their mortgage costs.

And, with no improvement in supply levels, rents have been continuing their upward march, increasing in every region of the UK in March. The average was up by 0.8% and by 9.1% annually. In London, where there had been a short lull in the rises, rents were up by 0.2% and by 11.8% annually (source: Homelet).

In better news, although the government will soon ban no-fault evictions (Section 21 notices), they are proposing to make it far easier to remove problem tenants. The Anti-Social Behaviour Action Plan would mean any form of anti-social behaviour or rental arrears could lead to an eviction with just two weeks’ notice.