- Finance

- Interest rates

- Mortgage

Mortgages and interest rates - December 2022

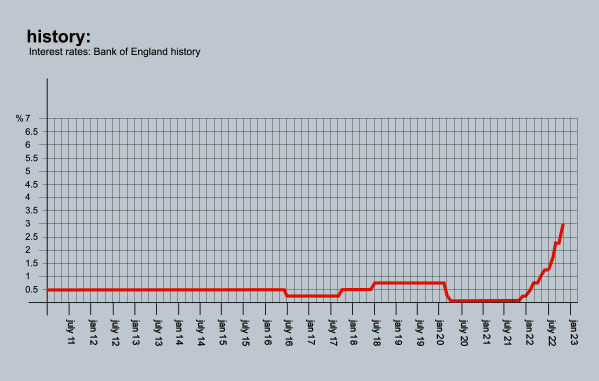

The base rate may have gone up by another 0.5% to 3.5% this December, but mortgage rates continue to come down. That’s because swap rates (the rate at which banks borrow money) are falling on the back of the money market’s increasing confidence that inflation and interest rates will peak far lower and sooner than had originally been anticipated. Andrew Bailey, Governor of the Bank of England, has even suggested inflation may have already done so.

The latest assumption is that the base rate will now reach a high point of around 4% to 4.5% in the early part of next year rather than 6.25% towards the end of 2023. It has meant that 5-year swap rates have fallen from 5.189% in October to 3.411% in December. To give you an idea of what that all means for mortgages – in December 2021, the average fixed-rate mortgage was as low as 2.34%. Just after the disastrous mini-budget, it shot up to 6.65%. Now the average is down to 5.78% and, at 60% LTV, there are quite a few deals sub 5% (see below). And the gap of nearly 2.4% between the current 5.78% fixed rate mortgages and five-year swap rates suggests there is plenty of room for further reductions.

And commentators are expecting those reductions in fixed-rate mortgages to continue throughout the course of next year, until they settle down to between 4% and 5%, with even lower rates for those with larger deposits. In the short-term, many borrowers are opting for tracker mortgages, especially ones with low or no early redemption fees, allowing them to secure the finance they need whilst hedging against future mortgage falls. When they bottom out, they can then move on to a fixed-rate product.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 4.99% from Generation Home. Product fee £999. 80% LTV.

5.15% from Generation Home. Product fee £999. 85% LTV.

Three-year fixed rates: 4.93% from Coventry BS. Product fee £999. 65% LTV.

5.03% from Coventry BS. Product fee £999. 75% LTV.

Five-year fixed rates: 4.99% from first direct. Product fee £490. 60% LTV.

4.99% from Nationwide. Product fee £999. 60% LTV.

Discounted variable: 3.29% Until 31/01/2025. From Newcastle BS. Product fee £999. 80% LTV.

3.29% For 2 years. From Scottish BS. Product fee £995. 60% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 4.29% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV.

Five-year fixed rate: 4.69% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV

Best Discounted variable: 3.74% for 3 years. From Family Building Society. Completion £999 (up to £500k). 60% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.