- News

- Property

House prices - December 2025

Rightmove’s latest index shows the sales market slowed sharply in November as widespread pre-Budget speculation over possible housing taxes caused buyers to delay decisions.

Average new seller asking prices fell by 1.8% to £364,833, the steepest November decline for more than a decade, as movers waited to see whether measures such as a mansion tax or higher capital gains tax would be introduced. The unusually high volume of property for sale also meant sellers had to price their homes competitively.

The slowdown was most pronounced in London and the south of England, where many of the rumoured taxes would have hit hardest, but there was also a degree of hesitation across the rest of the market, too. Nationwide reported a small monthly rise of 0.3% in November, while Halifax recorded no change- showing prices remained broadly stable even as activity was paused. Rightmove notes, however, that despite the quieter month, year-to-date sales agreed remained 4% higher than they were in 2024, in further confirmation that demand had been deferred rather than lost.

Colleen Babcock, property expert at Rightmove, said:

“The Budget is a big distraction, and is later in the year than usual, with many would-be buyers waiting to see how their finances will be impacted. It appears that the usual lull we’d see around Christmas time has arrived early this year, and sellers who are keen to move are having to work especially hard to entice buyers with competitive pricing.”

“This means that average new seller asking prices are now 0.5%, or £1,759 cheaper than a year ago. In addition, a third of homes already on the market for sale have had their asking price reduced, with an average reduction of 7%, further illustrating that this is a buyers’ market.”

The pause in activity, however, meant a large pool of pent-up demand had built up, with Zoopla reporting that two in five people were actively watching the market or preparing to enter it. Now that there is renewed certainty, the property industry is reporting an immediate bounce back, with a marked surge in enquiries and offers within 24 hours, with Zoopla saying the market now has its largest sales pipeline for four years.

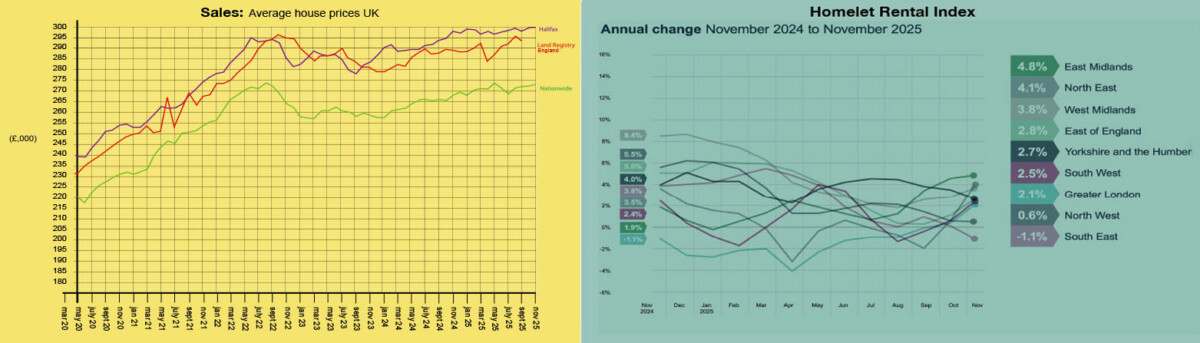

HOUSE PRICES AND STATISTICS

The indices all reveal a strong pre-budget slowdown, but won’t show the bounce back until next month.

Rightmove: Nov: Avg. price £364,833. Monthly change -1.8%. Annual change -0.5% (asking prices)

Nationwide: Nov: Avg. price £272,998. Monthly change +0.3%. Annual change +1.8%

Halifax: Nov: Avg. price £299,892. Monthly change +0.0%. Annual change +0.7%

Land Registry (England): Aug: Avg. price £293,292. Monthly change -0.8%. Annual change +2.0%

Zoopla: Oct: Avg. price £270,200. Annual change +1.3%

BUY-TO-LET

The rental market continued its seasonal slowdown in November. Goodlord reports that average rents across England fell by 2.4% to £1,245 – the fourth consecutive monthly drop since its July peak. Every region except the West Midlands recorded a fall, with the sharpest monthly declines occurring in Greater London and the North West.

In spite of the monthly drop, annual growth has picked up again, with rents now 3.3% higher than this time last year. The North West has seen the strongest annual rise at 6.6%, followed by the North East at 5%.

Voids, though, have lengthened from 21 days this time last year to 24 days, which is fairly typical for this time of year. The longest are in the West Midlands at 30 days, while London has the shortest gaps between tenancies at 20 days.

Goodlord CEO William Reeve says:

“Whilst month-on-month rental averages continue to mirror seasonal ebbs and flows we’d expect of the market, the uptick in the pace of annual rental inflation shows that supply and demand pressures aren’t abating. This could point towards new rental records being set next year and another intense year for the market, particularly as the Renters’ Rights Act comes into effect.”