- Finance

- Mortgage

Mortgages and interest rates - Jan 2025

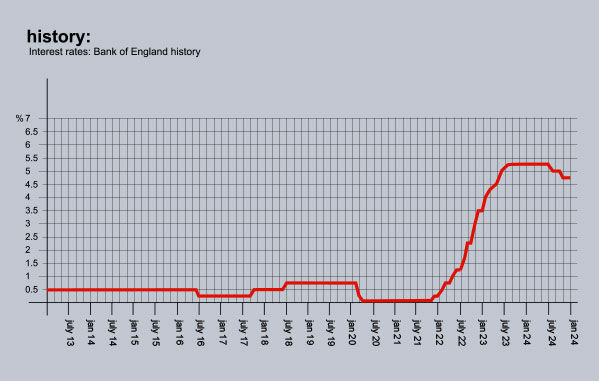

Mortgage rates may have retreated from their recent highs but there is no longer an expectation of substantial reductions in 2025.

At the start of 2024, the base rate was 5.25%, with five-year fixed mortgage rates averaging 5.03%. By January 2025, the base rate had been cut to 4.75%, and five-year fixed mortgage rates had fallen slightly to 4.63%.

However, Chancellor Rachel Reeves’ Autumn Budget in late 2024 has since had a significant impact on the outlook for borrowing costs. Big increases in borrowing and public spending are predicted to add £28 billion to annual public sector debt. This has pushed up government bond interest rates (gilt yields) to 4.8% – their highest in 17 years – making borrowing more expensive for both businesses and households.

It has raised concerns about whether this could lead to higher inflation, a weaker economy and higher unemployment and the Bank of England is now more cautious about cutting rates, as its priority is to keep inflation under control while supporting the economy.

As a result, many experts are now predicting a much slower reduction in the base rate, which is likely to drop to just 4% by the end of 2025. However, with inflation falling unexpectedly in December to 2.5%, the next base rate cut may now come as soon as next month.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 4.25% from Yorkshire BS. Product fee £995. 60% LTV.

4.34% from Nationwide BS. Product fee £490. 60% LTV.

Three-year fixed rates:4.27% from Yorkshire BS. Product fee £995. 60% LTV.4.29% from Nationwide BS. Product fee £999. 60% LTV.

Five-year fixed rates: 4.14% from First Direct. Product fee £490. 60% LTV.

4.14% from Nationwide BS. Product fee £995. 60% LTV.

Discounted variable: 4.24% For 2 years. From Progressive BS. Product fee £0. 75% LTV.

4.49% For 2 years. From Newbury BS. Product fee £850. 75% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 3.39% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV.

Five-year fixed rate: 3.94% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV

Best Discounted variable: 3.50% For 5 years. From The Stafford BS. Booking £100. Arrangement 5.00% Advance. 70% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.