- Finance

Mortgages and interest rates - August 2025

Mortgage costs have continued their downward trend in July, with major lenders launching a wave of cuts as competition intensifies.

Barclays, Coventry Building Society, Nationwide, Santander, Virgin Money and Yorkshire Building Society have all reduced selected rates during the first week of July, bringing the number of fixed-rate mortgage deals available with interest rates below 4% to 80, compared to just 26 such products in April.

The rate-cutting environment has been particularly beneficial for first-time buyers and borrowers with larger deposits. First-time buyers are also benefiting from relaxed stress testing rules, which are boosting affordability and making it easier for them to get on the property ladder.

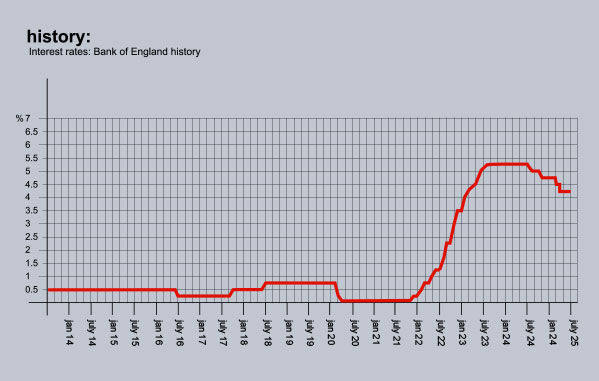

However, for the 1.8 million homeowners needing to remortgage this year, it may not seem like such a benign environment. Many are coming off ultra-low rates that were agreed before the base rate began rising in 2021, and so paying up to four times more for their mortgages will come as a shock.

They will be especially hopeful of further base rate cuts. However, the Bank of England kept rates on hold at 4.25% in June, although Governor Andrew Bailey suggested there could still be further cuts this year.

The markets are currently pricing in an 82% chance of a base rate cut as soon as next month, and most economists are expecting two further reductions this year.

The next meeting of the Bank of England’s Monetary Policy Committee is scheduled to take place on 7 August.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 3.93% from Yorkshire BS. Product fee £995. 60% LTV. For remortgages.

3.94% from Nationwide. Product fee £999. 60% LTV. For purchases.

Three-year fixed rates: 3.99% from Nationwide. Product fee £999. 60% LTV.

4.01% from first direct. Product fee £490. 60% LTV.

Five-year fixed rates: 3.99% from first direct. Product fee £490. 60% LTV. For remortgages.

4.04% from Nationwide. Product fee £999. 60% LTV.

Discounted variable: 4.19% For 3 years. From Newbury BS. Product fee £850. 95% LTV.

4.29% From Furness BS For 2 years. Product fee £999. 80% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 2.79% from The Mortgage Works. Product Fee Arrangement 3.00% Advance. 65% LTV.

Five-year fixed rate: 3.71% from The Mortgage Works. Product Fee Arrangement 3.00% Advance. 65% LTV.

Best Discounted variable: 3.05% from The Stafford BS. Product Fee Booking £100, Arrangement 5.00% Advance. 70% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.