- Finance

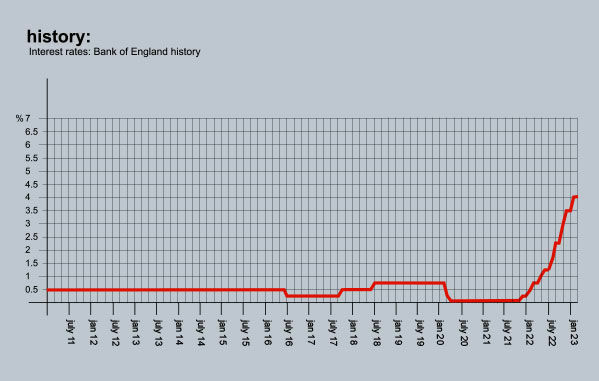

- Interest rates

- Mortgage

Mortgages and interest rates - March 2023

Last month, the best fixed-rate mortgages had dropped to just below 4%. This month, the base rate is expected to go up another 0.5% and, with inflation proving more stubborn than expected, swap rates (the rate at which banks borrow money) are rising. As a result, lenders are having to pass on those higher borrowing costs and the best deals are creeping back up again. Market commentators are predicting they will continue to nudge up for some months to come, with fixed rates eventually settling between 4% and 4.5%.

Andrew Bailey, Governor of the Bank of England, has given some fairly mixed messages on the subject, on the one hand, saying they may have peaked before then going on to say,

“At this stage, I would caution against suggesting either that we are done with increasing Bank rates, or that we will inevitably need to do more. Some further increase in Bank rate may turn out to be appropriate but nothing is decided.”

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 4.64% from Nationwide. Product fee £999. 60% LTV.

4.94% from Nationwide. Product fee £0. 60% LTV.

Three-year fixed rates: 4.44% from Nationwide. Product fee £999. 60% LTV.

4.73% from Nationwide. Product fee £0. 60% LTV.

Five-year fixed rates: 4.19% from Nationwide. Product fee £999. 60% LTV.

4.39% from Nationwide. Product fee £0. 60% LTV.

Discounted variable: 3.79% For 5 years. From Newbury BS. Product fee £600. 75% LTV.

3.79% For 2 years. From Progressive BS. Product fee £0. 60% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 3.99% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV.

Five-year fixed rate: 4.39% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV

Best Discounted variable: 3.99% From Hanley BS. Booking £299. 80% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.