- News

- Property

National property news - September 2022

With many families taking their first holidays in years, it is no surprise to find activity levels were down and asking prices dropped by 1.5% in August (source: Rightmove). The fall was very much in line with average, pre-pandemic figures for this time of year, so not much can be read into them. However, with the ongoing cost-of-living crisis, yet another base rate rise (see this month’s ‘Finance’), a change of Prime Minister and a new monarch, the big question is – what does it all mean for the housing market?

There is no doubt that the power vacuum left by the Tory leadership contest was very damaging. However, the appointment of a new leader, Liz Truss, and her announcement that energy prices would be frozen have taken much of the fear out of the cost-of-living crisis. In addition, the focus on the Queen’s sad demise and Charles’ succession have knocked it off the front pages. It won’t be for long, as the cost-of-living will continue to be a concern, but it should only have a dampening effect on house prices and the latest figures show demand is holding firm. Buyer enquiries are currently 20% above the level they were at in 2019. At the same time, although the supply of new property to the market has improved slightly, it remains restricted, with available stock down 39% over the same period. And, even though consecutive base rate rises have pushed the average mortgage payments to a new high for the typical first-time buyer – £1,000 per month for those with a 10% deposit – demand in the sector is still 32% higher than it was in 2019.

Tim Bannister, Rightmove’s Director of Property Science says:

”It’s likely that the impact of interest rate rises will gradually filter through during the rest of the year, but right now the data shows that they are not having a significant impact on the number of people wanting to move. Demand has eased a degree and there is now more choice for buyers, but the two remain at odds and the size of this imbalance will prevent major price falls this year. For those looking to move who are concerned about interest rate rises, it’s important that they get a mortgage in principle early on in their moving journey to understand what they could afford to borrow, and find out about the rates available to them to assess what they are able to repay each month.”

He went on to add that, despite the various headwinds, he is still expecting prices to be up by around 7% at the end of this year.

One area that may see substantial changes is demand for more energy-efficient properties. Nationwide Building Society has calculated that the average energy bill for a D-rated property (the most common) is set to rise by just over £1,250 a year. Properties between A and C will see average increases of nearly £1,000 a year and E-rated properties’ bills will be up by over £1,700 per year. The least energy-efficient properties– F and G – will see a massive £2,700 rise.

••NEWSFLASH••

In a move designed to stimulate the housing market, Chancellor Kwasi Kwarteng has just announced some significant cuts in Stamp Duty. The threshold at which first-time buyers pay the tax has been raised from £300,000 to £425,000 and, for everyone else, the tax threshold now begins at £250,000 rather than £125,000.

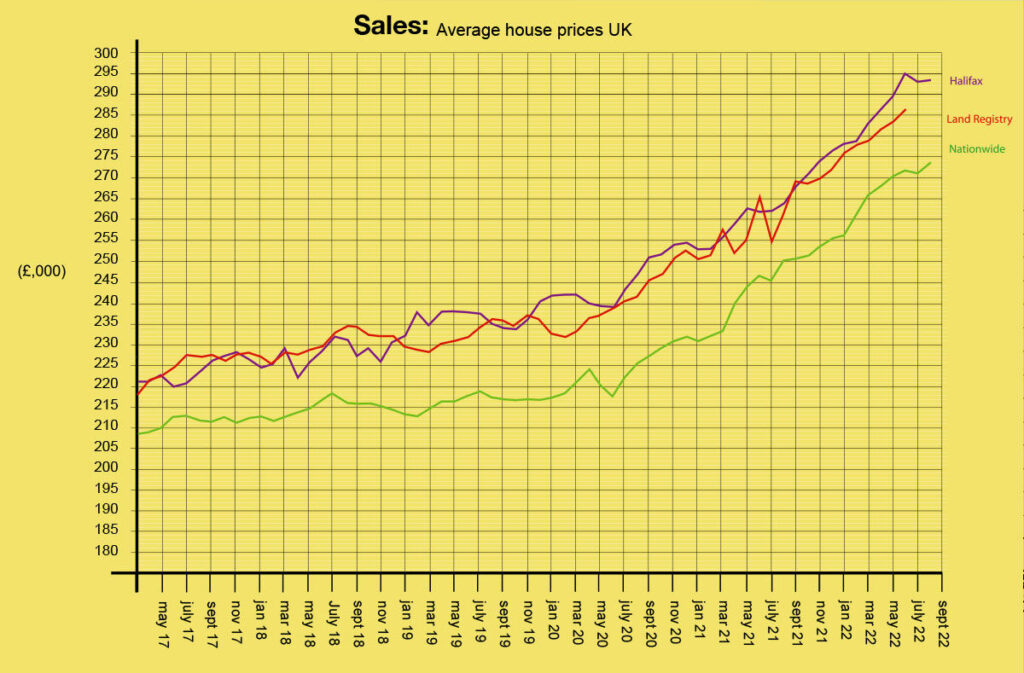

HOUSE PRICES AND STATISTICS

Although Rightmove’s index shows asking prices fell by 1.5% in August, Nationwide’s shows a rise of 0.8% and Halifax’s index was up by 0.4%.

Nationwide: Aug: Avge. price £273,751. Monthly change +0.8%. Annual change +10%

Halifax: Aug. Avge. price £293,221. Monthly change +0.4%. Annual change +11.5%

Land Registry: June: Avge. price £286,397. Monthly change +1.0%. Annual change +7.8%

Zoopla: Aug: Avge. price £256,900. Annual change +8.3%

Rightmove: Aug: Avge. price £365,173. Monthly change -1.3%. Annual change +8.2% (asking prices on Rightmove)

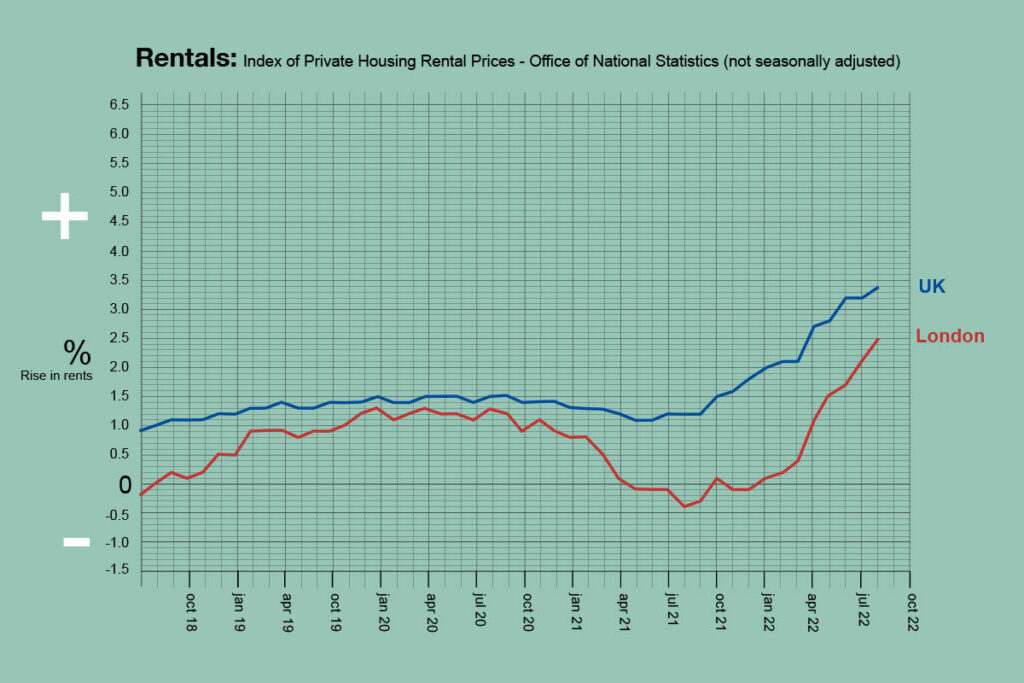

BUY-TO-LET

The rental market, unlike sales, shows no signs of slowing. This time last year, the average growth in rents was under 2%. Now, it is 12.3% (£1,051), which equates to an additional £115 per month for a typical tenant. The rise is a result of ongoing and chronic supply shortages. Currently, there is 50% less available stock than the average over the last five years and agents typically have just 8 available properties per branch. This lack of stock is being exacerbated not just by landlords selling up but also by tenants’ reluctance to move on. With choice limited and price rises considerably higher for new tenancies (+12.3%) than existing ones (+3.7%), many tenants are, unsurprisingly, choosing to stay put. In London, the conditions are even more challenging, with the average rent rising by a massive 17.8%.

In response to the rises and the cost-of-living squeeze, many prospective tenants are now looking for smaller properties that are cheaper to heat and rent. Demand for 1 and 2-bed flats has increased but has fallen for 2 and 3-bed houses. The rental market has not been functioning properly for some time, but instead of building new homes, which is the only real solution, consecutive governments have turned their fire on landlords instead, ensuring their exodus from the market and long-term shortages of rental property. With a new PM in place and a new Housing Minister – Simon Clarke – a more constructive approach would be welcomed by both landlords and tenants alike.