- News

- Property

Property news - August 2023

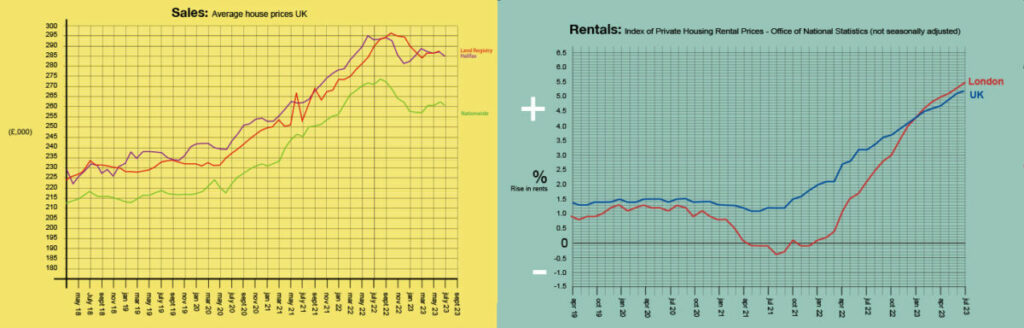

After last month’s better than expected figures, the markets have been watching very closely to see whether inflation is finally on the retreat. The latest data has now been released and, it seems, last month was no one-off, as headline inflation has dropped once again, down from 7.9% to 6.8%. If the trend continues next month, it could mark a turning point for the UK’s economy. That would be especially good news for the housing market as continually rising mortgage costs and the uncertainty over how high they might go has steadily chipped away at both prices and buyer confidence. There are still likely to be one or two more rises to come (see finances) but the base rate should peak earlier and some way below the 6.5% that had been forecast.

Despite it all, house prices are continuing to prove remarkably resilient. Halifax, Nationwide and Rightmove are all reporting falls in July but only between 0.2% and 0.3% in what is normally a flat month.

As Kim Kinnaird, Director, Halifax Mortgages, says:

“In reality, prices are little changed over the last six months, with the typical property now costing £285,044, compared to £285,660 in February. The pace of annual decline also slowed to -2.4% in July, versus -2.6% in June. These figures add to the sense of a housing market which continues to display a degree of resilience in the face of tough economic headwinds.”

According to the main indices, the area most affected by the rising base rate is sales volumes. Nationwide reports, in June, that they were 10% below pre-pandemic levels (2019) and the most up-to-date figures, Rightmove’s, show, in July, sales volumes were down by 12%. At the same time, there was a shortage in the supply of new properties coming up for sale, whose numbers were also down by 12%, which helped support prices.

It’s the top two tiers of the housing market – second-stepper and the top-of-the-ladder homes – that saw the biggest falls in sales volumes – down 14% on 2019 levels.

Surprisingly, it’s first-time buyer sales that are holding up the best, with many searching for smaller homes in order to offset their higher borrowing costs. As a result, sales volumes in the FTB sector had the smallest falls at 9%.

Looking ahead, it may be a while before the new, more positive inflationary data has any discernible effect on sales and prices, especially as more hesitant buyers will want to see inflation falling for a third month before making a move. After that, how the market responds will depend on how quickly and how far mortgage rates fall. Most commentators, however, are not expecting mortgages to come down significantly over the next 18 months, so house prices are unlikely to go shooting up again, but they should at least stabilise, with sales volumes returning to more normal levels.

HOUSE PRICES AND STATISTICS

This month, the most recent indices all show a small monthly fall of between 0.2% and 0.3%. Annually there is a greater disparity – their figures ranging from +0.5% to -3.8%.

Nationwide: July: Avge. price £260,828. Monthly change -0.2%. Annual change -3.8%

Halifax: July. Avge. price £285,044. Monthly change -0.3%. Annual change -2.4%

Land Registry: June: Avge. price £287,546. Monthly change 0.7%. Annual change +1.7%

Zoopla: June: Avge. price £260,500. Annual change +0.6%

Rightmove: July: Avge. price £371,907. Monthly change -0.2%. Annual change +0.5% (asking prices on Rightmove)

BUY-TO-LET

The latest data from Rightmove’s Rental index shows average asking rents for new tenants are now 33% higher than pre-pandemic 2019. They also note that, although rents have hit record highs- £2,567pcm in London and £1,231pcm outside it – the rises are finally starting to slow, with annual growth now dropping down to single digits, but only just (9.3%).

As has been the case for some time now, it’s the lack of supply that is driving up rents, although there has been a slight improvement. The number of properties available to let was up by 7% over the last twelve months whereas demand was up by just 3%. The ongoing imbalance, though, means the average property rents in just 17 days and competition between tenants is fierce. In May 2019, in the North West, there was an average of 7 enquiries per property. Now there are 30. That’s an increase of nearly 430%. In London, over the same period, enquiries rose by 300% and in Wales they were up by 400%.

The situation is unlikely to improve for some time to come but the rising base rate has at least meant the gap between the cost of renting and buying has closed markedly. Halifax compared the cost of renting a 3-bed house (£1,103) to the cost of buying it (£971pcm) for a first-time buyer and found the gap had come down from 12% last year to 4% this year, with an average difference of only £42 per month.