- Finance

- Mortgage

Mortgages and interest rates - Nov 2025

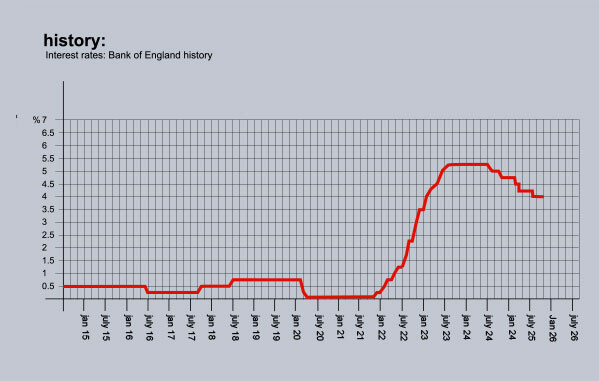

Despite the Bank of England’s decision to hold the base rate at 4%, mortgage rates have continued to edge downwards. Two and five-year fixed deals have both fallen again this month as lenders compete for a smaller pool of borrowers.

Average two-year fixed rates are now around 4.85%, with five-year deals averaging 4.72%. For borrowers with larger deposits, some sub-4% products have returned, with several major lenders launching new offers to attract remortgage business before the end of the year.

The reductions are the result of the easing of swap rates – the market measure that determines lenders’ funding costs – and growing confidence that interest rates have now peaked. Inflation remains above the Bank’s 2% target but is continuing to fall, giving lenders greater scope to trim pricing further.

However, many lenders remain cautious ahead of the Autumn Budget, waiting to see what signals the Chancellor sends about government spending and property taxation. If the markets think the Budget will make inflation harder to control — for example, through extra spending or higher borrowing — it could make it more expensive for banks to raise funds, leading to higher mortgage rates later on.

For now, most economists expect the base rate to remain at 4% into early 2026, with the first cut unlikely before spring.

Most forecasts suggest only gradual reductions thereafter, bringing the rate to around 3.75% by the end of next year if inflation continues to cool.

In the meantime, competition between lenders remains strong. Accord, HSBC and Santander have all unveiled new products this month, and Accord has launched a new online calculator to help borrowers compare affordability and repayments more easily.

For a typical £200,000 mortgage over 25 years, repayments now average around £1,140 a month on a two-year fix — around £60 less than earlier this year. Tracker and variable rates remain lower still, although most borrowers continue to prefer fixed deals while economic uncertainty persists.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 3.83% from Yorkshire BS. Product fee £995. 60% LTV. For remortgages.

3.84% from Nationwide. Product fee £999. 60% LTV.

Five-year fixed rates: 3.89% from Nationwide. Product fee £999. 60% LTV. For remortgages.

3.99% from first direct. Product fee £490. 75% LTV

Discounted variable: 4.04% For 3 years. From Newbury BS. Product fee £850. 75% LTV.

4.09% From Progressive BS For 2 years. Product fee £995. 60% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 2.64% from the mortgage works. Arrangement fee 3.00% Advance. 65% LTV.

Five-year fixed rate: 3.49% from Birmingham Midshires. Arrangement fee 3.00% Advance. 65% LTV

Best Discounted variable: 4.40% For 5 years. From Newbury BS. Arrangement £950. 75% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.