- Finance

Mortgages and interest rates - Nov 2024

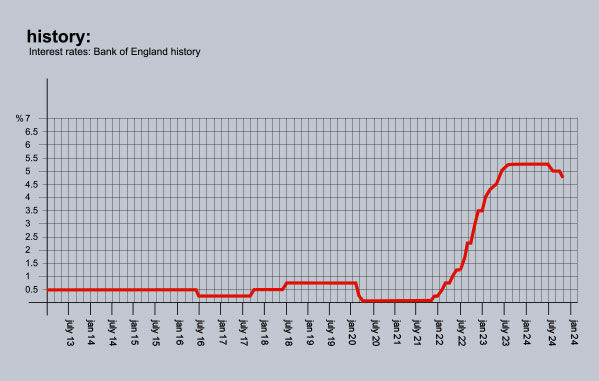

Mortgage rates were already falling when the Bank of England’s Monetary Policy Committee voted by 8 to 1 to cut rates for the second time in 2024. Labour’s spending plans though may now slow future reductions.

The government’s official forecaster, the Office for Budget Responsibility (OBR), has warned that mortgage rates may now remain higher than previously expected. That is because in Rachel Reeves’ budget she announced £40 billion in new taxes and plans to borrow an extra £32.3 billion over the next five years. When the government needs to borrow that level of money, it pushes up the cost of finance for everyone, including mortgages for homeowners.

As a result, many of the big lenders are currently raising mortgage rates, typically by around 0.3%, rather than cutting them. It means the Bank of England’s next interest rate decision will be even more closely watched as it weighs up improving economic data against the Government’s spending plans.

And, with the surprise rise in last month‘s inflation to 2.3%, the financial markets are busy adjusting their predictions for 2025.

Most are now betting that, when Reeves’ spending plans are combined with Trump’s election win, the base rate will now come down more slowly than originally thought and, after it reaches 4.5%, it will then remain there for an extended period.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 4.34% from Nationwide BS. Product fee £999. 60% LTV.

4.54% from first direct. Product fee £490. 60% LTV.

Three-year fixed rates: 4.29%4.29% from Nationwide BS. Product fee £999. 60% LTV.4.39% from first direct. Product fee £490. 60% LTV.

Five-year fixed rates: 4.14% from Nationwide BS. Product fee £999. 60% LTV.

4.29% > from first direct. Product fee £490. 60% LTV.

Discounted variable: 4.49% For 2 years. From Progressive BS. Product fee £0. 75% LTV.

4.59% For 2 years. From Scottish BS. Product fee £995. 60% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 3.24% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV.

Five-year fixed rate: 3.69% from The Mortgage Works. Arrangement 3.00% Advance. 65% LTV

Best Discounted variable: 4.90% For 2 years. From Monmouthshire BS. Arrangement 2.00% Advance. 75% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.