- News

House prices - July 2025

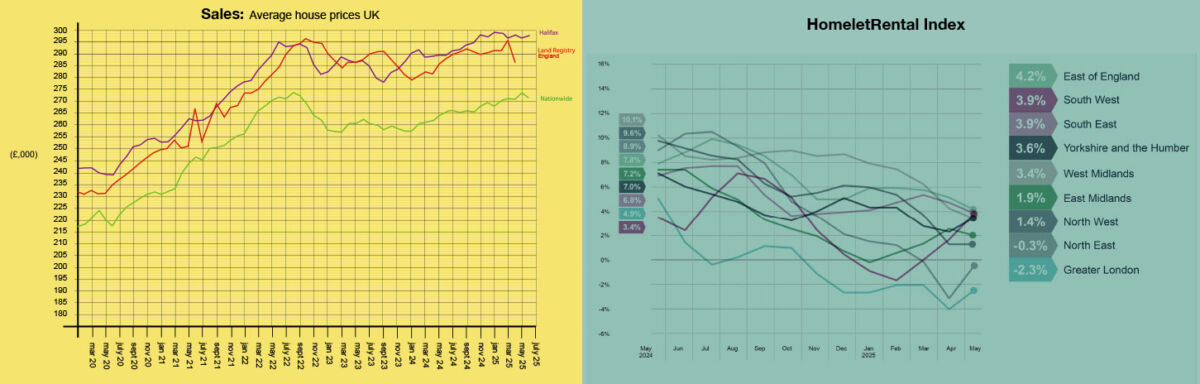

After the disruption caused by April’s stamp duty changes, the market appears to be finding its feet again. Halifax is reporting house prices were flat in June (0.0%), but that’s up from a 0.3% fall in May, with the average house price now standing at £296,665, some 2.5% higher than it was this time last year.

As ever, there were some wide regional variations. Northern Ireland recorded the fastest pace of annual growth in the UK at 9.6%, whilst the South West saw the weakest growth at just 0.5%. London sits near the bottom of the regional table with annual growth of just 0.6%.

Beneath those headline figures, though, there are some very encouraging signs. First-time buyer numbers have returned to pre-stamp duty rise levels, mortgage approvals have picked up and May saw the highest number of sales agreed since March 2022.

In addition, lenders have responded to new regulatory guidance by taking a more flexible approach to affordability assessments. Halifax, for example, says it has now given access to mortgage deals to 3,000 buyers (including more than 1,000 first-time buyers) over the last two months who wouldn’t previously have qualified.

Amanda Bryden, Head of Mortgages at Halifax, says:

“The market’s resilience continues to stand out and, after a brief slowdown following the spring stamp duty changes, mortgage approvals and property transactions have both picked up, with more buyers returning to the market.

“That’s being helped by a few key factors: wages are still rising, which is easing some of the pressure on affordability, and interest rates have stabilised in recent months, giving people more confidence to plan ahead.”

However, challenges remain – affordability is still stretched, particularly for those coming to the end of fixed-rate deals. The economic backdrop also remains uncertain; while inflation has eased, it’s still above target, and there are signs the jobs market may be softening.

Rightmove’s data shows asking prices fell by 0.3% in June, as more properties came onto the market and sellers were forced to lower their expectations amidst increasing levels of competition.

And Nationwide is reporting prices fell by as much as 0.8%, although the lender says it is almost certainly the result of the stamp duty rise and is expecting activity to pick up during the course of the summer.

HOUSE PRICES AND STATISTICS

There was some marked variation in the monthly figures in June. This may indicate we are at a turning point, where the market is picking up after the stamp duty rise, and that is feeding through to some of the indices faster than others.

Nationwide: June: Avge. price £271,619. Monthly change -0.8%. Annual change +2.1%

Halifax: June. Avge. price £296,665. Monthly change 0.0%. Annual change +2.5%

Land Registry: April: Avge. price £286,327. Monthly change -3.7%. Annual change +3.0%

Zoopla: May: Avge. price £268,400. Annual change +1.4%

Rightmove: June: Avge. price £378,240. Monthly change -0.3%. Annual change +0.8% (asking prices on Rightmove)

BUY-TO-LET

Rents continue to rise, but the pace of growth is showing yet more signs of moderating. HomeLet’s rental index reveals the average UK rent increased to £1,307 in May, up 0.7% monthly and just 0.8% higher than a year ago.

There was a more mixed picture in London, where the average rose by 0.3% in May to £2,088, but that’s 2.3% lower than it was a year ago. Within London’s boroughs, though, there are some very wide variations, ranging from 8.1% annual growth in Barnet to a 7.5% fall in Lambeth.

On a regional level, HomeLet reports the strongest annual rises are occurring in the East of England at 4.2%, South West at 3.9%, and South East at 3.9%. Greater London’s 2.3% fall makes it one of the weaker-performing regions.

Demand from tenants, however, remains robust, as for the first time in four months, void periods shortened, dropping to 20 days in May.

That may in part be due to tightening supply. Industry analysis suggests smaller-scale landlords are increasingly selling their rental properties ahead of the Renters’ Rights Bill and those numbers could accelerate after it becomes law sometime in the autumn.

On a more positive note, rental affordability is slowly improving. Homelet’s data shows UK tenants are now spending 33.1% of their income on rent, down from 33.5% a year ago. In London, where rents are much higher, affordability is heading in the opposite direction, with tenants now spending 39.2% of their incomes on rent, up from 38.9% in 2024.