- Finance

- Mortgage

Mortgages and interest rates - Dec 2025

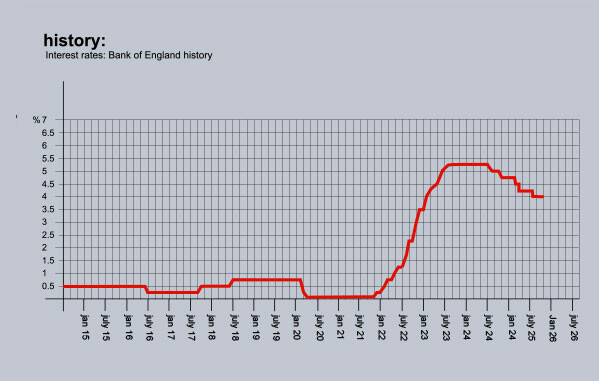

The Bank of England has voted by 5-4 to cut the base rate by 0.25 percentage points to 3.75 per cent, its lowest level in almost two years. Mortgage rates had already been falling, though, with many high-street lenders reducing their product costs ahead of the Bank’s, which had been widely anticipated.

That’s because mortgage costs are linked to swap rates, which are what lenders use to price their products. They are based on the predicted future direction of the Bank of England’s base rate over the course of a loan, rather than its current value.

At the same time, with housing activity a little quieter than usual, lenders are facing increased competition and are having to frequently reduce the price of their mortgages to attract new business.

It means, according to Moneyfacts, the average two-year fixed rate is now around 4.86%, while the average five-year fix sits at roughly 4.91%, which is the lowest it has been since the infamous Liz Truss mini-budget in 2022. Product availability has also improved, rising above 7,000. At the same time, 24 lenders have reduced their rates in just one week, with some cutting as much as 0.35 percentage points from their fixed-rate deals.

There has also been a modest improvement in the availability of first-time-buyer mortgages at higher loan-to-values, with more 90% and 95% LTV options returning to the market.

Many analysts expect the base rate to continue drifting lower during 2026, with most forecasting around two further rate cuts during the course of the year. If that happens, it will ensure mortgage costs continue on their downward path.

Below is a selection of this month’s best buys from Moneyfacts.co.uk:

Two-year fixed rates: 3.70% from Nationwide. Product fee £999. 60% LTV. For remortgages.

3.79% from first direct. Product fee £490. 60% LTV.

Five-year fixed rates: 3.79% from Nationwide. Product fee £999. 60% LTV. For remortgages.

3.84% from first direct. Product fee £490. 75% LTV

Discounted variable: 4.04% For 3 years. From Newbury BS. Product fee £850. 75% LTV.

4.09% From Ecology BS For 2 years. Product fee £0. 80% LTV.

BUY-TO-LET (BTL)

Best two-year fixed rate: 2.70% from Birmingham Midshires. Arrangement fee 3.00% Advance. 75% LTV.

Five-year fixed rate: 3.44% from The Mortgage Works. Arrangement fee 3.00% Advance. 65% LTV.

Best Discounted variable: 4.40% For 5 years. From Newbury BS. Arrangement £950. 75% LTV.

The information we provide is our personal opinion and should not be relied upon for financial advice. Should you need financial advice or guidance please contact an appropriate professional.